The Light Aircraft Sector Shines

In 2022, the light sport and kitbuilt markets showed steady sales.

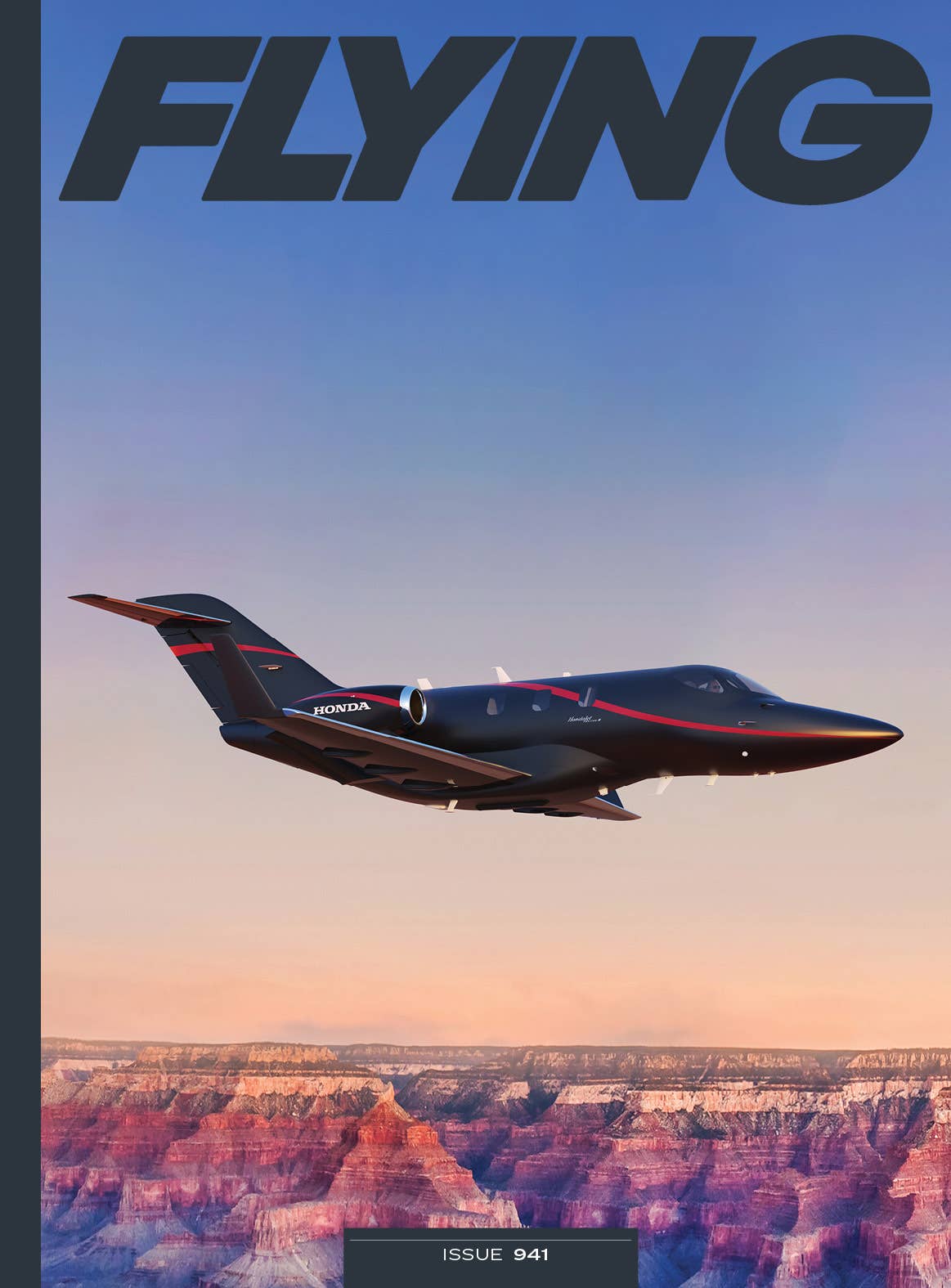

[Credit: Jim Barrett]

The year started with hope. As 2022 arrived, the U.S. and most countries were emerging from two years of difficult lockdowns. The good news? A flood of subsidy money buoyed markets—and I’ve long observed that when equities are rising, light sport and sport pilot-eligible kit aircraft sell well. Economists call this a “wealth effect,” where rising asset values give stockholders confidence that good times are here. Aviation translation: Pilots can afford an airplane to have fun.

If you're not already a subscriber, what are you waiting for? Subscribe today to get the issue as soon as it is released in either Print or Digital formats.

Subscribe NowThen... Russia invaded Ukraine and the global markets trembled.

The General Aviation Manufacturers Association released information recently showing positive results for 2022 in every category they report. The closest corollary to light sport aircraft and sport pilot-eligible kitbuilt aircraft is GAMA’s “piston airplanes” category, which showed an 8.2 percent gain over 2021.

When we examine only U.S. aircraft information and omit multiengine aircraft, the single-engine piston category shows 1,005 U.S. aircraft deliveries. In comparison, the overall light aircraft market totaled 738 new registrations, or 73 percent of what GA builders delivered. Note that deliveries and registrations may differ in any given year, but tend to converge over time.

Despite a year of war, plunging stock markets and sky-high energy prices, protests and riots in multiple countries, huge increases in freight cost, plus ongoing supply chain challenges and lingering COVID-19 fears, the light aircraft market nonetheless grew by a very healthy 18 percent, as compared to a rising 10 percent in 2021. The industry is now performing better than in 2019, the last year of relative stability before COVID.

Let’s Unpack the Numbers

I am using a different approach for analysis this year, partly to give added perspective, given the challenging start to the 2020s. You can get more detail on the Tableau Public market share data by visiting bydanjohnson.com.

Here I cover only aircraft called out in the adjacent table—including light sport aircraft and kitbuilt aircraft a pilot can operate using sport pilot certificate privileges, significantly meaning no medical is required. The data rely 100 percent on FAA registration records, which are then closely reviewed by industry experts. This report offers aircraft registration data current through the end of 2022—professionally analyzed by computer database expert Steve Beste. Category explanations are provided below.

I grouped all the light aircraft data into these categories:

- Combined Results, All Categories, includes fully-built, kitbuilt, ELSA (experimental light sport aircraft), and also portrays how the FAA’s 1990s-era primary category touches this segment.

- SLSA (special light sport aircraft) and ELSA arepresented as a group because all must ship conforming to the SLSA model first accepted by the FAA. After an ELSA owner takes delivery, that person can make changes without factory approval but then loses the chance to offer compensated flight instruction or rental of their aircraft.

- SLSA Only covers only ready-to-fly aircraft, separate from ELSA. SLSA can be used for compensated operations like flight instruction and rental.

- EAB (experimental-amateur built) and ELSA are shown as a group because in both cases the owner can alter and maintain the aircraft.

- EAB Only separates the ELSA out of the strictly homebuilt segment.

- ELSA are also shown separately, as they can become quite different from the SLSA model in which they began life. An owner can change avionics and interiors, add equipment, or even change the engine.

Two remaining categories include experimental-exhibition, used mostly by Pipistrel for its motorglider models in this context; and the primary category that presently counts only AutoGyro as an OEM. Models that pursued primary category certification back in the 1990s (such as the Quicksilver GT500) have not continued with that approach.

Changes in Light Aircraft Categories: 2020-2021-2022

| Category Type | 2020 | 2021 | Change | % | 2022 | CHANGE | % |

| Combined Results, All Categories | 567 | 624 | 57 | 10% | 738 | 114 | 18% |

| Special and Experimental LSA | 219 | 252 | 33 | 15% | 307 | 55 | 22% |

| Special LSA Only (SLSA) | 159 | 195 | 36 | 23% | 225 | 30 | 15% |

| Experimental LSA Only (ELSA) | 60 | 57 | -3 | -5% | 82 | 25 | 44% |

| Experimental Amateur Built and ELSA | 403 | 409 | 6 | 1% | 494 | 85 | 21% |

| Experimental Amateur Built Only | 343 | 352 | 9 | 3% | 412 | 60 | 17% |

| Experimental Exhibition and Other | 2 | 11 | 9 | 450% | 9 | -2 | -18% |

| Primary Category (AutoGyro only) | 1 | 2 | 1 | 100% | 5 | 3 | 150% |

Which Models Sold Best?

The best-selling model overall came from Van’s Aircraft with their RV-12 series (with the original Rotax 912-powered model and the newer version with the Rotax 912iS), which supplied 61 of the best-selling single model of light aircraft in the FAA registry for 2022. Of these, 13 were fully-built SLSA models; the balance of 47 RV-12s were ELSA (plus one more registered as EAB). Most ELSA left the factory essentially complete, as I understand it.

Going the ELSA route has attracted a certain type of buyer interested in fully maintaining or modifying their aircraft. The RV-12 alone accounts for 43 percent of all such aircraft registered in 2022.

In what I term “alternative aircraft” in this sector, powered parachute manufacturer Powrachute accounted for another 15 ELSA, and Wild Sky Goat (a weight-shift aircraft) registered six more. The remaining18 ELSAs were produced by 12 other producers.

One note reveals the presence of two fully-built Bristell USA aircraft that were registered ELSA to permit IFR operations (yes, that is possible; more on that in future articles in FLYING).

The best-selling SLSA (fully-built) comes as no surprise, so I’ll skip the suspense and tell you it was ICON’s A5, which registered 33 aircraft in 2022 to lead the ready-to-fly pack. In second, fourth, fifth, and sixth places were Tecnam (19 SLSA), Vashon (15), Sling (13), and Super Petrel (11). The third most-registered brand deserves a special mention for 2022. Despite a war in its Ukraine homeland and suffering direct damage from the conflict, Kyiv-based Aeroprakt added 17 aircraft to the FAA registry in 2022. Good U.S. partners help.

One interesting factoid in the database is the 2022 registration of two Cessna 162 Skycatchers. Since the modelis long out of production—in fact, all remaining brand-new, partly-finished Skycatchers were chopped up and crushed in 2016, so one wonders how a pair of them were added to the database last year.

The best-selling kit builder is another ongoing winner. Zenith, with 91 registrations, has led the pack almost as long as I’ve followed these statistics. Zenith has several models, but their Sky Jeep CH-701 and -750 series contribute to the bulk of the company’s kit deliveries. Remember, kit sales don’t precisely relate to registrations, as owners have to assemble them first. This can take months to years.

Trailing Zenith rather closely are the usual producers: Rans (59 kits; plus 2 SLSA), Sonex (45), Kitfox (38; plus 2SLSA), and Just Aircraft (30). Right behind is Magni (16) because gyroplanes—other than AutoGyro’s primary category models (five registered in 2022)—must be built as kits until the MOSAIC implementation corrects this FAA oversight. AutoGyro also sells kit versions (15 registered). LSA seaplane builder Progressive Aerodyne built Searey kits (10) plus 6 SLSA models.

Among “alternative aircraft” in this space, Powrachute powered parachutes registered 25 aircraft, including 16 kits and 9 SLSA models. In the weight shift category, Evolution Trikes was the leader with 11 registrations, of which seven were SLSA. The company also reports good sales of its non-registered Part 103 aircraft, adding to their total.

The post-COVID period has been kind to the lighter aircraft segment. With some deliveries already quoting into 2024, industry players hope the good news can continue through 2023.

This article was originally published in the April 2023, Issue 936 of FLYING.

Subscribe to Our Newsletter

Get the latest FLYING stories delivered directly to your inbox