Turboprops: Power Up

Incredible capability and efficiency make the category shine.

Response to Daher’s Kodiak 900 has been strong. [Credit: Jim Barrett]

The turboprop market cruises along, still propelled by the surge in demand as the world worked its way through the COVID-19 pandemic in 2021 and 2022—though numbers have drawn back slightly. That’s a scenario that’s OK for most OEMs that have struggled with lingering supply chain pain points.

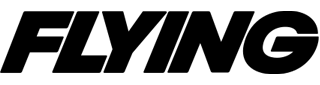

In 2022, a total of 505 single-engine turboprops (SETs) were delivered, according to the General Aviation Manufacturers Association (GAMA), besting the 2021 and 2020 totals of 455 and 381, respectively. That’s a healthy market that should continue, even as pressure from the war in Ukraine continues in Europe with aftershocks globally. On the multiengine side, a total of 77 units went out the door in 2022, up from 72 in 2021, and 62 in 2020.

Single-Engine

FLYING Editors’ Choice Award winner for Aircraft in 2023, Daher's Kodiak 900, leads the group in combining utility with efficiency. Though FAA certification was announced in summer 2022—and European Union Aviation Safety Agency (EASA) approval in April—deliveries were just beginning in earnest as we went to press. “The difficulty that our aviation industry [is] having these days is to manage the supply chain,” said Nicolas Chabbert, senior vice president of Daher’s aircraft division, at EAA AirVenture this summer. “We are working with great partners...but all the suppliers are needed to complete an aircraft, and this is still a problem. So the Kodiak 900 deliveries have just started, and we intend to have eight deliveries of the Kodiak 900 this year, and next year, it’s going to be 50 percent of the output, so 15 aircraft.”

- READ MORE: We Fly: Daher Kodiak 900

Daher fielded not one but two new turboprops in 2022—and while the Kodiak 900 looks very different on the outside from its predecessor (the 100 Series III), the other, the TBM 960, shows its significant evolution on the inside. The business end of it, the Pratt & Whitney PT6E-66XT turboprop, is on full display, but the brains, the Garmin GDL 60, only gained full signoff in July, though it had been in place on the 960 since its debut in March last year. Daher also continues to expand roles for its Kodiak 100 Series III—on tricycle gear or floats—in multimission and public service roles.

- READ MORE: We Fly: Daher TBM 960

The Piper M Class continues to perform well in the market, according to Ron Gunnarson, vice president of sales and marketing for Piper Aircraft. Gunnarson noted strong continued sales of the M500 and M600/SLS Halo introduced in late 2019 with Garmin’s Autoland on board—though he too called out the ongoing supply chain issues. “We remain in a ‘pull’ market—probably the strongest market that any of us have ever seen, including those who have been here for 30 or more years,” said Gunnarson at AirVenture. “It’s not pulling as hard as it was a year ago, but it was unsustainable. It was collapsing our traditional supply chain. It was pulling on the resources of every OEM and every major supplier.”

- READ MORE: We Fly: Piper M600/SLS Halo

Still, the push to get aircraft into customers’ hands continues. Epic Aircraft fielded the update to its certified SET, the E1000 GX, in fall 2021, and in 2022 it delivered 16 of the fast turboprop to customers. So far in the first quarter of 2023, it only shipped two units, hampered by those same supply chain constraints. Pilatus Aircraft also remains sold out into 2025 on its longevous PC-12 NGX.

- READ MORE: We Fly: Epic Aircraft E1000 GX

Sustainable aviation fuel plays a critical part in the strength of the single-engine turboprop (SET) market, as it identifies a near-term path toward net-zero emissions for these airframes, though it is hardly as easy to implement as it seems on paper. Nicholas Kanellias, vice president of general aviation for Pratt& Whitney Canada, said in a press conference at AirVenture: “We’re focusing on the future. We realize that we need to be able to optimize the engine, but [SAF] has to also be accessible for the customer base that we’ve got.”

Greater operational efficiency is also made possible by advancements in the turboprop engine that powers most SETs, the Pratt & Whitney PT6 series. Now in its “E” versions—as in the PT6E-67XP on the PC-12NGX—the powerplant is integrated with the airframe through the engine and propeller electronic control system, which streams data usable by both the pilot, Pratt & Whitney, and the airframe OEM. “[Pilots] can monitor whatever parameters they need to in order to fly the aircraft, while we monitor over 100 parameters for the engine,” said Kanellias. That greater data transparency is likely to advance turboprops toward reducing emissions as much as the net gain currently seen in using 30 percent SAF from varying sources—and in distribution worldwide that is uneven at best until better standards have been set.

Multiengine

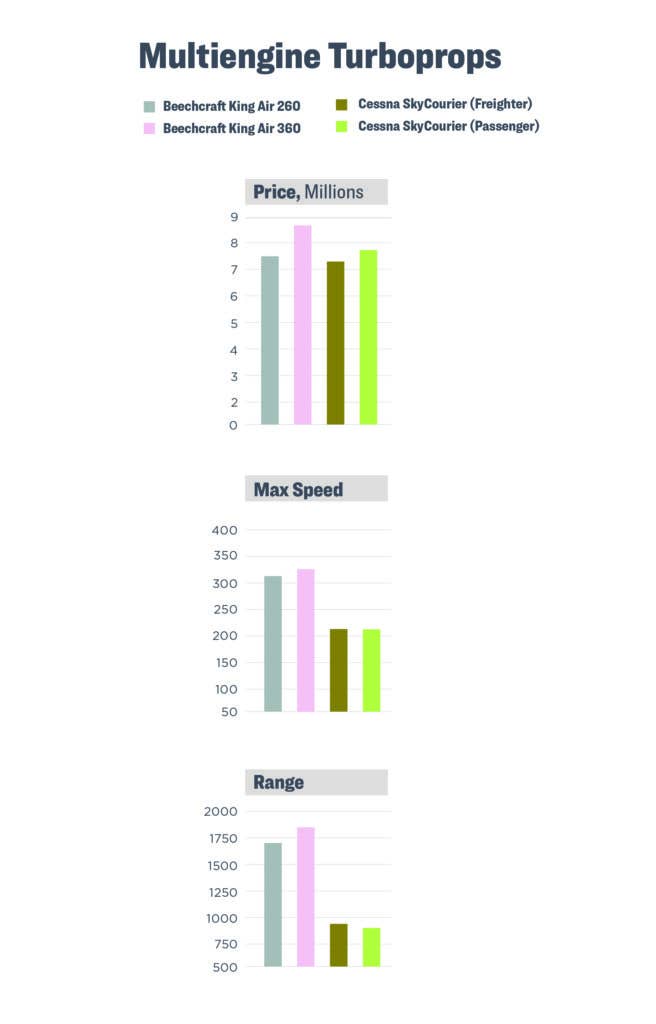

Textron Aviation advanced the multiengine turboprop (MET) game on its own in 2021 and 2022 with the debuts of the next generation Beechcraft King Air 260 and 360/360ER to replace the 200 and 350, respectively, as well as the short-haul mount, the Cessna SkyCourier.

- READ MORE: We Fly: Beechcraft King Air 360

The King Air 260 marked a total of 35 deliveries in 2022 to best slightly the 360/ER’s total of 34 units. The SkyCourier saw six deliveries to launch customer FedEx, beginning in May 2022—but it also notched its first airline customer, Aerus, a new regional airline in Mexico, which will operate the company’s Cessna Grand Caravan EX as well.

Subscribe to Our Newsletter

Get the latest FLYING stories delivered directly to your inbox